The Real Cause of Inflation

We see lots of reports on TV, newspapers, magazines, etc. about higher prices for oil or higher wages or low unemployment causing inflation. Bunk. Inflation is not rising prices. It is not rising wages (i.e. the price of labor). These are not causes of inflation but effects of inflation. A rise in the price of one thing, even something like oil that is used for many other things, does not cause a general price increase.

Considering that the USA lived through a serious bout of prolonged inflation just 25 years ago, this lack of understanding of the problem is appalling. It's not particularly surprising, though, since few understood it at the time.

The real cause of inflation becomes apparent once we use the correct definition of inflation. In a nutshell: Inflation is a decline in the value of money. The decline in a currency's value will eventually become apparent as a general rise in the the prices of goods, services and labor. However, these price changes occur simply as a reaction to the fall in the currency's value (or sometimes in anticipation of that fall).

This misunderstanding as to the nature of inflation has led to many misguided, doomed attempts to fight it. Richard Nixon imposed a disastrous freeze on wages and prices. [Has there ever been a non-disastrous freeze on prices?] Jimmy Carter contributed his own foolishness: a freeze on gasoline prices and rationing. Gerald Ford gave us the ludicrous "Whip Inflation Now (WIN)" campaign, complete with buttons.

None of these policies ever had any chance of success, because none of them addressed the real cause of inflation. They amount to fighting a fever by putting the thermometer into cold water (or in the case of WIN, cheering for the thermometer to go down).

So what causes a "decline in the value of money?" An important clue comes from the U.S. Constitution, which in Article 1; Section. 8: Clause 5 gives Congress the exclusive power:

Like any other commodity, the value of a dollar is ultimately determined by the laws of supply and demand. Normally, though, we think of the dollar on the "x-axis," representing the price/value of the commodity rather than being the commodity.

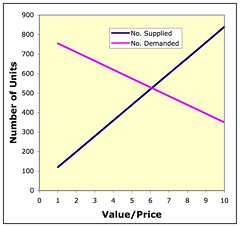

The chart at the right represents supply and demand curves for an arbitrary commodity, say "widgets." The supply curve (blue) represents the collective behavior of sellers of widgets. The higher the price, the more they will produce and sell. If the price drops, they will cut production. Buyers of widgets respond in the opposite way (purple line). If widgets become too costly, they will buy other things instead. If widgets become a bargain, they will buy more. The interactions of individual buyers and sellers in the market establish the point where the curves cross (i.e. number offered equals number demanded), the "equilibrium price." A shift in either the supply or demand curve will result in a new equilibrium price.

Applying the same thinking to the dollar requires some other measure of value. In principle this could be anything of stable, recognized value. Gold, the Euro, the Swiss Franc, or even interest rates would all be possibilities. Each has some advantages and drawbacks, but we'll ignore those issues here. We also make no distinction here between the domestic (e.g. Consumer Price Index) and foreign exchange value of the dollar. Ultimately, these are somewhat different measures of the value of the currency, but complementary.

The supply of dollars is often thought of as being "fixed" at a given point in time, or "controlled by the Fed." In fact even defining the "money supply" is difficult. What are the real differences among a dollar bill, a deposit in a bank, and a long term Treasury Bond? In the end, they are all just different forms of "money." There are also dollar-denominated instruments issued in foreign countries that are completely outside of the control of the Fed. The Fed has some control over the supply of money, but this control is far from perfect.

The demand for "dollars" (i.e., including dollar-denominated assests) comes from all over the world. Little old ladies in Peoria have them in the bank or under the mattress. American companies and investors large and small hold them. Foreign individuals, corporations and central banks also hold huge amounts of dollars.

People, particularly foreigners, hold dollars because of the strength and relative safety of the American economy and the political system that underlies it. Their collective desire to continue to do so is critical to maintaining the value of the dollar today (and hence, low inflation). The Fed's ability to manage this side of things is extremely limited. There is really only the control of domestic interest rates and the domestic money supply.

Given a stable demand curve, the Fed can tweak the money supply to keep inflation subdued, at least in theory. In practice, it's a bit like trying to drive by looking in the rearview mirror. However, a negative shift in the demand for dollars could bring about a big drop in the value of the dollar and a return of inflation, leaving the Fed with no good options.

The actions of the rest of the federal government are beyond the control of the Fed, but these have big impacts on the demand for dollars. First of all, we require continued robust economic growth. This depends on the private economy and good policies from the government. The government produces nothing, so it can't help directly, although it can do plenty of harm. Runaway government spending requires high taxes or high borrowing, and both of these are harmful to the economy and the value of the dollar. The byzantine federal regulatory apparatus is already a millstone around the neck of the private economy. Relief of this burden would help, and we can't afford to make it worse. Protectionist trade policies are also bad on many levels. Giving investors any reason to think we favor a "cheaper dollar" is asking for trouble. There is no example of a country becoming "rich" by destroying the value of its currency.

Maintaining the value of the dollar today, a world of fractional reserve banking and instantaneous international monetary flows, is much more complex than it was at the founding of the Republic. However, monetary stability remains the responsibility of the federal government and lack of it is directly caused by government policies. We are already seeing some signs inflation may be returning, particularly in the drop in the foreign exchange values of the dollar. Reversing this decline is critical. The way to do that is reducing the burden of government on the country (spending and regulation) and pursuing sensible trade and monetary policies.

Considering that the USA lived through a serious bout of prolonged inflation just 25 years ago, this lack of understanding of the problem is appalling. It's not particularly surprising, though, since few understood it at the time.

The real cause of inflation becomes apparent once we use the correct definition of inflation. In a nutshell: Inflation is a decline in the value of money. The decline in a currency's value will eventually become apparent as a general rise in the the prices of goods, services and labor. However, these price changes occur simply as a reaction to the fall in the currency's value (or sometimes in anticipation of that fall).

This misunderstanding as to the nature of inflation has led to many misguided, doomed attempts to fight it. Richard Nixon imposed a disastrous freeze on wages and prices. [Has there ever been a non-disastrous freeze on prices?] Jimmy Carter contributed his own foolishness: a freeze on gasoline prices and rationing. Gerald Ford gave us the ludicrous "Whip Inflation Now (WIN)" campaign, complete with buttons.

None of these policies ever had any chance of success, because none of them addressed the real cause of inflation. They amount to fighting a fever by putting the thermometer into cold water (or in the case of WIN, cheering for the thermometer to go down).

So what causes a "decline in the value of money?" An important clue comes from the U.S. Constitution, which in Article 1; Section. 8: Clause 5 gives Congress the exclusive power:

"To coin Money, regulate the Value thereof, and of foreignThis is not just a coincidence. Yes, inflation is made in Washington. It is not the fault of "greedy" businessmen or unions (or foreign sheiks). The US government creates the dollar and maintains, or fails to maintain, the value of the currency by the actions it takes. Today this is done mainly through the Federal Reserve Board on a day-to-day basis. However, Congressional and Presidential actions (and statements) also impact the dollar's value in numerous ways.

Coin, and fix the Standard of Weights and Measures;"

Like any other commodity, the value of a dollar is ultimately determined by the laws of supply and demand. Normally, though, we think of the dollar on the "x-axis," representing the price/value of the commodity rather than being the commodity.

The chart at the right represents supply and demand curves for an arbitrary commodity, say "widgets." The supply curve (blue) represents the collective behavior of sellers of widgets. The higher the price, the more they will produce and sell. If the price drops, they will cut production. Buyers of widgets respond in the opposite way (purple line). If widgets become too costly, they will buy other things instead. If widgets become a bargain, they will buy more. The interactions of individual buyers and sellers in the market establish the point where the curves cross (i.e. number offered equals number demanded), the "equilibrium price." A shift in either the supply or demand curve will result in a new equilibrium price.

Applying the same thinking to the dollar requires some other measure of value. In principle this could be anything of stable, recognized value. Gold, the Euro, the Swiss Franc, or even interest rates would all be possibilities. Each has some advantages and drawbacks, but we'll ignore those issues here. We also make no distinction here between the domestic (e.g. Consumer Price Index) and foreign exchange value of the dollar. Ultimately, these are somewhat different measures of the value of the currency, but complementary.

The supply of dollars is often thought of as being "fixed" at a given point in time, or "controlled by the Fed." In fact even defining the "money supply" is difficult. What are the real differences among a dollar bill, a deposit in a bank, and a long term Treasury Bond? In the end, they are all just different forms of "money." There are also dollar-denominated instruments issued in foreign countries that are completely outside of the control of the Fed. The Fed has some control over the supply of money, but this control is far from perfect.

The demand for "dollars" (i.e., including dollar-denominated assests) comes from all over the world. Little old ladies in Peoria have them in the bank or under the mattress. American companies and investors large and small hold them. Foreign individuals, corporations and central banks also hold huge amounts of dollars.

People, particularly foreigners, hold dollars because of the strength and relative safety of the American economy and the political system that underlies it. Their collective desire to continue to do so is critical to maintaining the value of the dollar today (and hence, low inflation). The Fed's ability to manage this side of things is extremely limited. There is really only the control of domestic interest rates and the domestic money supply.

Given a stable demand curve, the Fed can tweak the money supply to keep inflation subdued, at least in theory. In practice, it's a bit like trying to drive by looking in the rearview mirror. However, a negative shift in the demand for dollars could bring about a big drop in the value of the dollar and a return of inflation, leaving the Fed with no good options.

The actions of the rest of the federal government are beyond the control of the Fed, but these have big impacts on the demand for dollars. First of all, we require continued robust economic growth. This depends on the private economy and good policies from the government. The government produces nothing, so it can't help directly, although it can do plenty of harm. Runaway government spending requires high taxes or high borrowing, and both of these are harmful to the economy and the value of the dollar. The byzantine federal regulatory apparatus is already a millstone around the neck of the private economy. Relief of this burden would help, and we can't afford to make it worse. Protectionist trade policies are also bad on many levels. Giving investors any reason to think we favor a "cheaper dollar" is asking for trouble. There is no example of a country becoming "rich" by destroying the value of its currency.

Maintaining the value of the dollar today, a world of fractional reserve banking and instantaneous international monetary flows, is much more complex than it was at the founding of the Republic. However, monetary stability remains the responsibility of the federal government and lack of it is directly caused by government policies. We are already seeing some signs inflation may be returning, particularly in the drop in the foreign exchange values of the dollar. Reversing this decline is critical. The way to do that is reducing the burden of government on the country (spending and regulation) and pursuing sensible trade and monetary policies.

<< Home